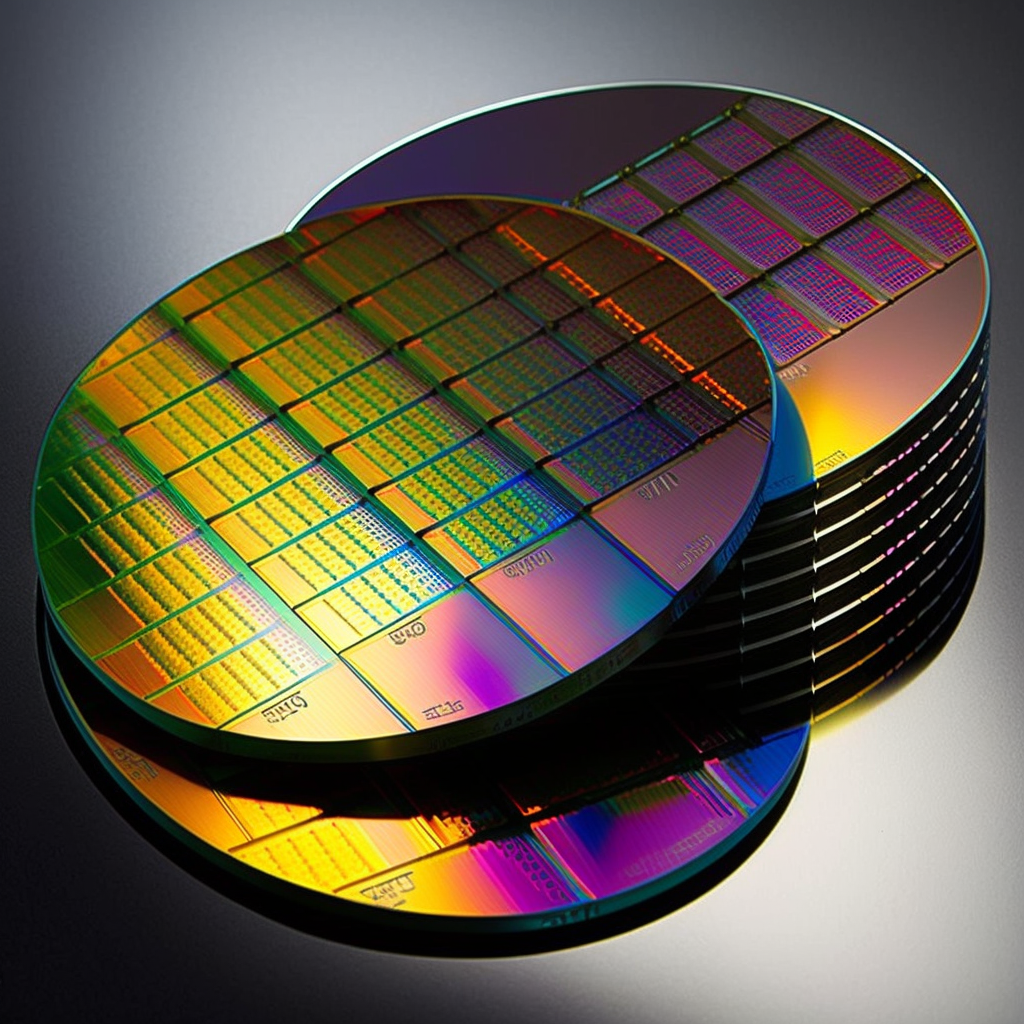

According to latest report by IMARC Group, titled “Silicon Wafer Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032,” offers a comprehensive analysis of the silicon wafer market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. the global silicon wafer market size reached US$ 12.2 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 17.5 Billion by 2032, exhibiting a growth rate (CAGR) of 4% during 2024-2032.

The global silicon wafer market is experiencing substantial growth, driven by the escalating demand for electronic devices such as smartphones, laptops, and tablets. The proliferation of the Internet of Things (IoT) and the expanding adoption of artificial intelligence (AI) and machine learning technologies are further propelling the demand for high-performance semiconductors. Additionally, the automotive industry's shift towards electric and autonomous vehicles is driving the need for advanced semiconductor components, thereby increasing the demand for silicon wafers. Along with this, the continuous advancements in semiconductor technology, including the development of smaller, faster, and more efficient chips, are enhancing the performance and application scope of silicon wafers. Moreover, the rising investments in 5G infrastructure and the increasing deployment of data centers are creating substantial growth opportunities for the silicon wafer market.

Request Sample Report (Exclusive Offer on this report): https://www.imarcgroup.com/silicon-wafer-market/requestsample

Competitive Landscape with Key Players:

- Global Wafers Singapore Pte. Ltd

- Okmetic Oy

- Shanghai Simgui Technology Co. Ltd

- Shin-Etsu Chemical Co., Ltd

- Silicon Materials Inc

- Siltronic AG

- SK Siltron Co., Ltd

- Sumco Corporation

- Tokuyama Corporation

- Virginia Semiconductor, Inc

- Wafer Works Corporation

Silicon Wafer Market Trends:

The global market encompasses a wide range of products essential for the fabrication and packaging of semiconductor devices. This market includes various types of silicon wafers, such as monocrystalline, polycrystalline, and epitaxial wafers, each catering to specific applications and performance requirements. The market's growth is further supported by the increasing complexity of semiconductor devices and the demand for higher performance, driving innovations in material science and engineering. In addition, the adoption of advanced manufacturing technologies, such as chemical vapor deposition (CVD) and molecular beam epitaxy (MBE), is enhancing the quality and efficiency of silicon wafers. Apart from this, the expansion of semiconductor manufacturing facilities in emerging economies, driven by favorable government policies and incentives, is creating new growth opportunities. Furthermore, the rising focus on sustainable and eco-friendly manufacturing processes is leading to the adoption of green materials and technologies in silicon wafer production.

Ask Analyst for Instant Discount and Download Full Report with TOC & List of Figure: https://www.imarcgroup.com/silicon-wafer-market

Silicon Wafer Market Report Segmentation:

Breakup by Wafer Size:

- 0 – 100 mm

- 100 – 200 mm

- 200 – 300 mm

- More than 300 mm

Wafers larger than 300 mm dominated the largest segment by wafer size due to their efficiency in producing more chips per wafer, reducing costs, and meeting the high demand for semiconductors in advanced technology applications.

Breakup by Type:

- N-type

- P-type

P-type silicon wafers were the largest segment by type, primarily due to their widespread use in various semiconductor devices, attributed to their positive charge carrier conductivity and compatibility with a wide range of applications.

Breakup by Application:

- Solar Cells

- Integrated Circuits

- Photoelectric Cells

- Others

Solar cells emerged as the largest segment by application, driven by the global shift towards renewable energy sources, where silicon wafers are essential for manufacturing photovoltaic cells due to their efficiency in converting sunlight into electricity.

Breakup by End-Use:

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

- Others

Consumer electronics constituted the largest segment by end use, as silicon wafers are fundamental components in the manufacturing of electronic devices, such as smartphones, laptops, and tablets, which have a high consumer demand.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

The Asia Pacific region was the largest market, attributed to its robust electronics manufacturing sector, significant investments in technology and infrastructure, and the presence of key semiconductor and solar cell manufacturers.

Key highlights of the report:

- Market Performance

- Market Outlook

- Porter’s Five Forces Analysis

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163