Loan Servicing Software Market Overview:

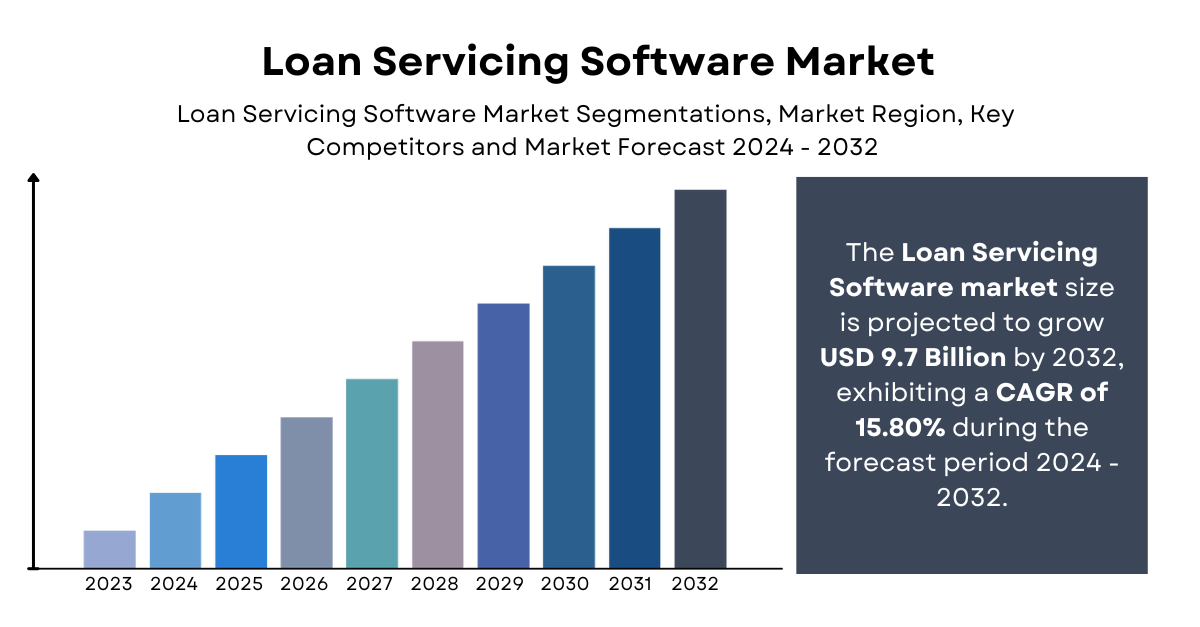

The loan servicing software market has seen significant growth over the past decade, driven by the increasing demand for streamlined financial operations and enhanced customer experience. This software facilitates the management of loan processes, including payment collection, customer communication, and compliance with regulatory requirements. Financial institutions, ranging from banks to credit unions, are increasingly adopting these solutions to improve efficiency, reduce errors, and ensure compliance. The market's expansion is also fueled by the growing need for automation and digital transformation in the financial sector. The Loan Servicing Software market size is projected to grow from USD 3.01 Billion in 2023 to USD 9.7 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 15.80% during the forecast period (2023 - 2032).

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/11661

Industry News:

Recent industry news highlights several key developments in the loan servicing software market. Major players are focusing on enhancing their software capabilities through the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements are designed to improve risk assessment, automate decision-making processes, and provide personalized customer experiences. Additionally, the COVID-19 pandemic has accelerated the adoption of digital solutions, with many financial institutions transitioning to remote operations. This shift has underscored the importance of reliable and efficient loan servicing software. Mergers and acquisitions are also prevalent, with companies seeking to expand their market share and broaden their technological capabilities. Furthermore, regulatory changes in various regions are prompting updates and innovations in loan servicing software to ensure compliance and mitigate risks.

Market Segmentation:

The loan servicing software market is segmented based on deployment mode, organization size, and end-user industry. Deployment modes include on-premises and cloud-based solutions. Cloud-based deployment is gaining traction due to its scalability, cost-effectiveness, and ease of access. Organization size segmentation divides the market into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting loan servicing software to enhance their competitive edge and streamline operations. In terms of end-user industry, the market is segmented into banks, credit unions, mortgage lenders, and others. Banks hold a significant share of the market due to their extensive loan portfolios and the need for efficient loan management systems. Mortgage lenders are also notable users, given the complexities involved in mortgage loan servicing.

Market Key Players:

Key players in the loan servicing software market include Fiserv, Inc., Fidelity National Information Services, Inc. (FIS), Mortgage Builder Software, Inc., Nortridge Software, LLC, and Ellie Mae, Inc. These companies are at the forefront of innovation, continually enhancing their software offerings to meet evolving market demands. Fiserv, Inc. is known for its comprehensive suite of financial services technology, while FIS offers a wide range of solutions for banking and payments. Mortgage Builder Software, Inc. provides specialized software for mortgage loan servicing, and Nortridge Software, LLC focuses on flexible and customizable loan servicing solutions. Ellie Mae, Inc., a subsidiary of Intercontinental Exchange, is a leader in cloud-based platforms for the mortgage finance industry. These key players are investing heavily in research and development to integrate advanced technologies and stay ahead in the competitive market.

Regional Analysis:

The loan servicing software market is analyzed across various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, attributed to the presence of major financial institutions and advanced technological infrastructure. The United States, in particular, is a significant contributor to market growth, driven by the high adoption rate of digital solutions in the financial sector. Europe follows closely, with countries like the United Kingdom, Germany, and France leading the way. The Asia-Pacific region is expected to witness the highest growth rate, fueled by the rapid digitalization of financial services and increasing demand for efficient loan management systems in emerging economies such as China and India. Latin America and the Middle East & Africa are also showing promising growth potential, with financial institutions in these regions gradually embracing digital transformation and automated solutions.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/loan-servicing-software-market-11661

Recent Developments:

Recent developments in the loan servicing software market include the integration of blockchain technology to enhance security and transparency in loan transactions. This innovation is particularly beneficial for mortgage lenders, as it reduces the risk of fraud and improves data integrity. Additionally, there is a growing trend towards the use of cloud-native platforms, which offer greater flexibility and scalability compared to traditional on-premises solutions. Companies are also focusing on improving user interfaces and customer experiences through the use of AI-driven chatbots and automated customer support systems. Another notable development is the increasing emphasis on regulatory compliance, with software providers incorporating features that help financial institutions adhere to evolving regulations and reporting requirements. These advancements are not only enhancing the functionality of loan servicing software but also contributing to the overall growth and dynamism of the market.

The loan servicing software market is experiencing rapid growth driven by technological advancements, regulatory changes, and the increasing demand for efficient financial management solutions. As the market continues to evolve, key players are investing in innovation and strategic collaborations to maintain their competitive edge. With the ongoing digital transformation in the financial sector, the future of the loan servicing software market looks promising, offering numerous opportunities for growth and development.

Top Trending Reports:

Secure Access Services Edge Market

Software Quality Assurance Market

Social and Emotional Learning (SEL) Market

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com